Oberlin Student Workers Affected by January Minimum Wage Increase

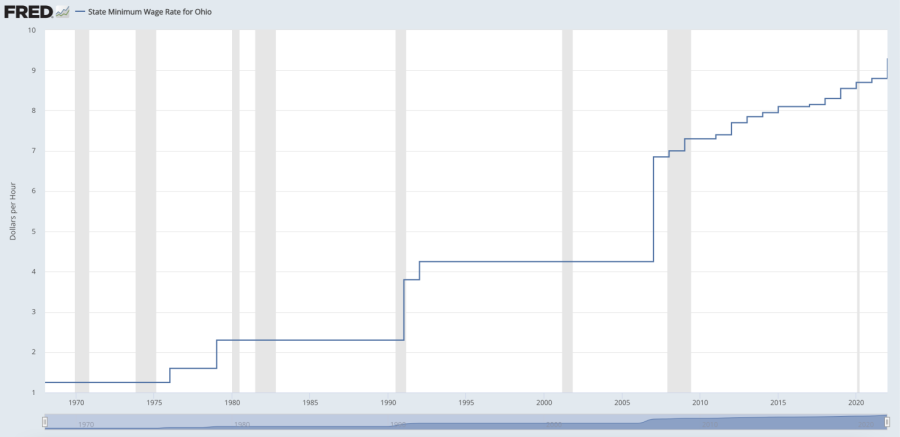

The Ohio minimum wage has seen an annual increase since 2007.

On Jan. 1, 2023, the Ohio minimum hourly wage will increase from $9.30 to $10.10 for non-tipped workers and from $4.65 to $5.05 for tipped workers. This increase will only apply to “employees of businesses with annual gross receipts of $372,000 or more per year,” according to a press release by the Ohio Department of Commerce most recently updated Nov. 4.

This increase comes as part of a policy of annual wage hikes: Ohio State Constitution Amendment II-34a, ratified in November of 2006, mandates a statewide minimum wage increase on the first of every year to account for inflation.

“On the thirtieth day of each September, beginning in 2007, this state minimum wage rate shall be increased effective the first day of the following January by the rate of inflation for the twelve month period prior to that September according to the consumer price index or its successor index for all urban wage earners and clerical workers for all items as calculated by the federal government rounded to the nearest five cents,” the amendment reads.

College second-year and Bonner Scholar Selene Pan, who works as an employee relations liaison and a social entrepreneurship fellow, currently makes $10 an hour at both of her jobs.

“For me, it doesn’t make much difference,” Pan said.

As an international student, Pan’s financial calculations differ from those of many domestic students who receive financial aid, leaving her with limited options to both budget her current spending and earn surplus income.

“My scholarship is related to on-campus dining, on-campus housing,” she continued. “So if I actually buy things — if I actually cook for myself off campus or if I wanna switch off the meal plan or on-campus housing, I actually lose money because they decrease my scholarship. There’s not really much that I can do in terms of getting more money, apart from trying to work as hard as possible. … This is literally the minimal increase of minimum wage.”

However, College second-year Tabitha Bird-Bott, who earns the minimum wage as a circulation desk assistant in the libraries and above minimum wage as manager of the Cat in the Cream, feels differently.

“It will make it a whole lot easier to feel like I am not drowning, because really, any money is good money when it comes to being self-sustaining.”

Bird-Bott’s decision to take on their personal finances was largely motivated by a desire to relieve their parents’ financial stress, which includes pitching in to pay their younger sister’s expenses. As for the wage increase’s impact on these finances, Bird-Bott is excited to make more per hour.

“I’ve currently been picking up probably one hour at the circ desk for every two hours at the Cat,” Bird-Bott said. “But I really like that the circulation desk is a lot more chill — I can actually hear myself think, unlike a lot of Cat events. So, it will definitely make it more appealing to work here, because I always find myself reaching for Cat hours for the money, since I do have to pay for things like food. But yeah, I’m quite excited about that.”

As for how the increase will affect their day-to-day life, Bird-Bott may choose to take on fewer hours — or perhaps days — of work to account for the increase, as the fiscal result will remain the same.

“I was looking a lot at [my] budget, and just an 80-cent increase is like three dollars per shift, which is an entire day’s worth of food,” Bird-Bott said. “Which would be really nice to be able to just say, ‘Okay … I can take at least a whole day off work.”